If you’ve ever found yourself in a tight financial spot, you may have come across payday loans as a potential solution. These short-term, high-interest loans have become a popular option for those in need of quick cash. However, it’s essential to understand how payday loans work and the reasons why you should think twice before jumping at the opportunity. In this article, we’ll explore the mechanics behind payday loans and shed light on the potential pitfalls they can present. By the end, you’ll have a clearer understanding of why it’s often best to steer clear of these seemingly convenient financial lifelines.

This image is property of www.pacificvoyagers.org.

Understanding Payday Loans

Definition of payday loans

Payday loans are short-term loans that are designed to be repaid on your next payday. These loans are typically small in amount and are meant to provide quick cash to individuals who may be facing unexpected financial emergencies. However, they often come with high interest rates and fees, making them an expensive option for borrowing money.

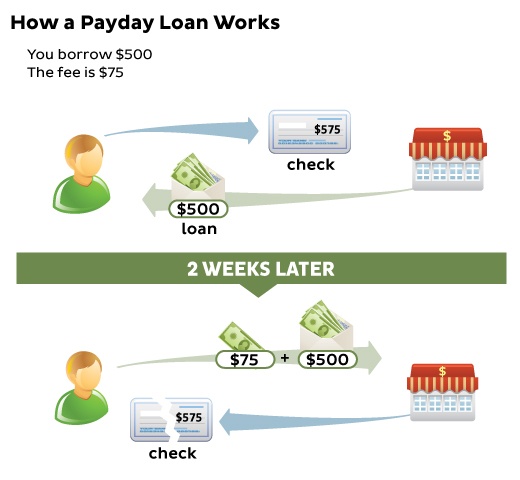

How payday loans work

To obtain a payday loan, you typically need to provide proof of income and a valid checking account. The lender will then assess your financial situation and determine the amount you are eligible to borrow. If approved, you will receive the funds directly into your bank account. On your next payday, the lender will automatically withdraw the loan amount plus fees from your account.

Requirements for obtaining a payday loan

In order to qualify for a payday loan, you will typically need to meet several requirements. These requirements may vary depending on the lender and the state in which you reside. Common requirements include having a regular source of income, being at least 18 years old, and having an active checking account.

Repayment terms and interest rates

Payday loans usually have short repayment terms, typically ranging from two weeks to a month. The interest rates on payday loans can be extremely high, often reaching triple-digit percentages. This means that if you borrow $500, you may end up having to repay $600 or more. Additionally, if you are unable to repay the loan on time, you may face additional fees and penalties, which can further escalate the cost of the loan.

The Dangers of Payday Loans

High-interest rates and fees

One of the major dangers of payday loans is the high-interest rates and fees associated with them. The exorbitant interest rates can trap borrowers in a cycle of debt, making it difficult to repay the loan. Moreover, the upfront fees charged by payday lenders can significantly increase the overall cost of borrowing, putting borrowers at a higher risk of financial instability.

Cycle of debt

Because payday loans require repayment within a short period of time, many borrowers find themselves unable to fully repay the loan on their next payday. As a result, they are forced to renew or rollover the loan, incurring additional fees and interest charges. This can create a cycle of debt, where borrowers repeatedly borrow and repay their loans, but never fully eliminate their debt.

Negative impact on credit scores

Payday loans can have a negative impact on credit scores, especially if the borrower fails to repay the loan on time. Late or missed payments can be reported to credit bureaus, resulting in a lower credit score. This can make it difficult to qualify for future loans or credit cards, and may even affect other aspects of your financial life, such as renting an apartment or getting a job.

Financial impact on borrowers

The financial impact of payday loans on borrowers can be significant. Borrowers may struggle to meet their basic needs and other financial obligations due to the high cost of repaying the loan. This can lead to a cycle of financial instability, where individuals become more reliant on payday loans to cover their expenses, further exacerbating their financial situation.

Alternatives to Payday Loans

Personal budgeting and financial planning

Creating and sticking to a personal budget can help you manage your finances more effectively and avoid the need for payday loans. By tracking your income and expenses, you can identify areas where you can cut back on spending or find ways to increase your income. This can help you build up savings and create a financial cushion to rely on in case of emergencies.

Emergency savings funds

Building an emergency savings fund is another alternative to payday loans. By setting aside a portion of your income each month, you can gradually build up a fund that can be used to cover unexpected expenses. Having an emergency savings fund can provide you with financial security and peace of mind, reducing the need to rely on payday loans in times of crisis.

Credit union loans

Credit unions often offer more affordable loan options compared to payday lenders. They typically have lower interest rates and fees, making them a more favorable alternative for borrowing money. Additionally, credit unions often provide financial counseling and other resources to help borrowers improve their financial situation.

Short-term installment loans

Short-term installment loans are another alternative to payday loans. These loans allow you to borrow a fixed amount of money and repay it in regular installments over a set period of time. The interest rates and fees associated with short-term installment loans are often lower than those of payday loans, making them a more manageable option for many borrowers.

Assistance from family and friends

If you are facing a financial emergency, reaching out to family and friends for assistance can be a viable option. This avoids the high costs and risks associated with payday loans. However, it is important to approach these conversations with transparency and open communication, as borrowing money from loved ones can impact relationships if not handled properly.

Credit card cash advances

If you have a credit card with available credit, a cash advance from your credit card can be an alternative to a payday loan. Cash advances allow you to withdraw money from your credit card, typically with higher interest rates than regular purchases. While this may still incur fees and interest charges, it can be a less expensive option compared to payday loans.

Regulations and Laws Regarding Payday Loans

State and federal regulations

Payday loan regulations vary by state and are subject to federal laws. Some states have implemented stricter regulations to protect consumers from predatory lending practices, while others have more lenient regulations. It is important to familiarize yourself with the laws in your state before considering a payday loan.

Consumer Financial Protection Bureau (CFPB)

The Consumer Financial Protection Bureau (CFPB) is a government agency tasked with regulating the financial industry and protecting consumers. The CFPB has implemented rules and regulations specifically targeted at payday lenders to ensure fair and transparent lending practices. By filing complaints with the CFPB, borrowers can seek assistance and report any unfair or deceptive practices by payday lenders.

Loan rollovers and cooling-off periods

Some states have implemented regulations to limit the number of times a payday loan can be rolled over or renewed. This is to prevent borrowers from getting trapped in a cycle of debt. Additionally, certain states may require a cooling-off period between consecutive payday loans, giving borrowers time to assess their financial situation and explore alternative options.

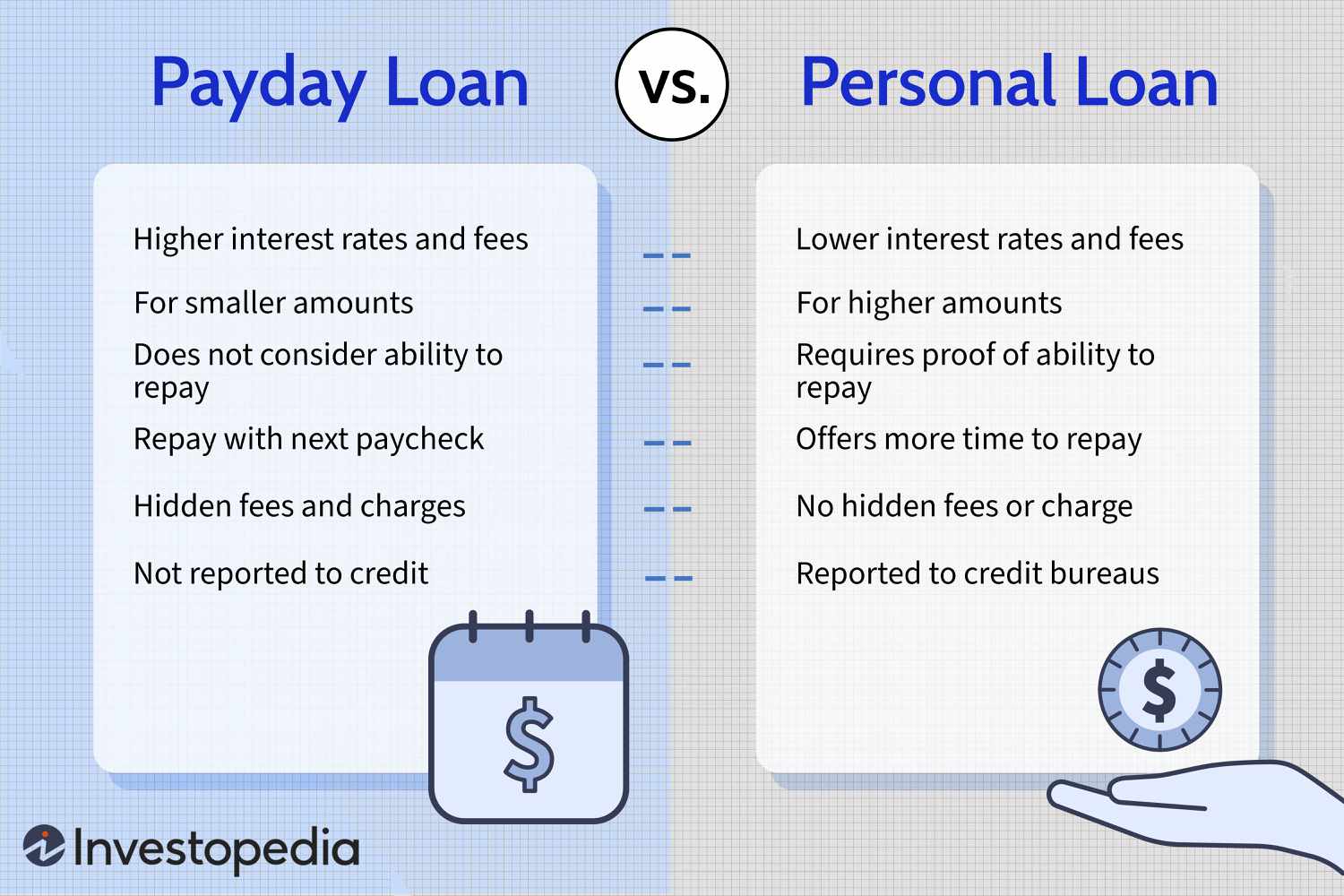

This image is property of www.investopedia.com.

Tips for Avoiding Payday Loans

Create a budget and track expenses

Creating a budget and tracking your expenses can help you gain better control over your finances and avoid the need for payday loans. By understanding your income and expenses, you can make informed decisions about your spending and identify areas where you can save money.

Build an emergency fund

Building an emergency fund should be a priority in your financial planning. By setting aside a portion of your income each month, you can gradually build up savings that can be used to cover unexpected expenses. Having an emergency fund can provide you with a financial safety net and reduce the need to rely on payday loans.

Improve credit scores

Maintaining good credit scores can open up alternative borrowing options with lower interest rates and fees. Paying bills on time, keeping credit card balances low, and avoiding unnecessary debt can help improve your credit scores over time. This can provide you with more favorable loan terms and reduce the need for payday loans.

Seek financial counseling or advice

If you are experiencing financial difficulties, seeking professional financial counseling or advice can be beneficial. Financial counselors can help you assess your situation, create a realistic budget, and explore alternative options for borrowing money. They can also provide guidance on improving your financial habits and achieving long-term financial stability.

Common Myths about Payday Loans

Payday loans improve credit scores

Contrary to popular belief, payday loans do not improve credit scores. In fact, payday lenders often do not report to credit bureaus, so repaying a payday loan on time will not have any positive impact on your credit history. On the other hand, late or missed payments can be reported, resulting in a negative impact on your credit scores.

Payday loans are a reliable solution for emergencies

While payday loans may seem like a quick and easy solution for emergencies, they come with significant risks and costs. The high interest rates and fees associated with payday loans can make them a costly and unsustainable option. It is important to explore alternative options that provide more favorable terms and help you avoid falling into a cycle of debt.

This image is property of www.investopedia.com.

Payday Loan Industry Practices

Advertising and marketing tactics

The payday loan industry often utilizes aggressive advertising and marketing tactics to target vulnerable individuals who may be in need of quick cash. These tactics may include misleading advertisements, promises of instant approval, and the inclusion of hidden fees and charges. It is important for consumers to be cautious and fully understand the terms and risks associated with payday loans before considering them as an option.

Targeting low-income individuals and communities

Payday lenders often target low-income individuals and communities who may have limited access to traditional financial services. These individuals may already be financially vulnerable, making them an easy target for predatory lending practices. It is crucial to address the underlying issues of financial inequality and provide more accessible and affordable financial services to these communities.

Legal and ethical concerns

The payday loan industry has faced legal and ethical concerns regarding their lending practices. Many consumer advocacy groups argue that payday lenders take advantage of vulnerable individuals by charging exorbitant interest rates and fees. Additionally, some payday lenders have been accused of engaging in predatory practices, such as forcibly deducting loan payments from borrowers’ bank accounts without their consent.

Case Studies of Payday Loan Borrowers

Personal stories of individuals trapped in payday loan debts

There are numerous personal stories of individuals who have found themselves trapped in a cycle of payday loan debts. These stories often highlight the struggles faced by borrowers in repaying the loans and the negative impact it has had on their financial wellbeing. They serve as a reminder of the potential dangers and risks associated with payday loans.

Lessons learned from case studies

Case studies of payday loan borrowers highlight the importance of financial literacy and responsible borrowing. They emphasize the need for individuals to fully understand the terms and costs of payday loans before entering into an agreement. Additionally, the stories provide insights into alternative solutions and resources that borrowers can explore to avoid falling into the payday loan trap.

This image is property of suitsmecard.com.

Impact of Payday Loan Industry on Society

Economic consequences on communities

The payday loan industry can have significant economic consequences on communities. The high interest rates and fees associated with payday loans drain resources from low-income communities, making it difficult for individuals to escape the cycle of debt. This can perpetuate poverty and exacerbate existing financial inequalities within these communities.

Lobbying and political influence

The payday loan industry has been known to exert its political influence through lobbying efforts. These efforts aim to shape legislative policies and regulations in favor of payday lenders and their profit margins. Such influence can hinder the implementation of stricter regulations and consumer protections, making it challenging to address the predatory practices of the industry.

Implications for financial wellness and stability

The payday loan industry’s practices can have long-lasting implications on individuals’ financial wellness and stability. Focusing on short-term relief rather than long-term solutions, payday loans can hinder individuals from building healthy financial habits and achieving financial goals. This can hinder economic growth and stability at both the individual and societal levels.

Conclusion

Understanding the workings of payday loans and the associated dangers is crucial in making informed financial decisions. While payday loans may provide quick cash, they often come with high interest rates, fees, and the potential for a cycle of debt. Exploring alternatives such as personal budgeting, emergency savings funds, and loans from credit unions can help individuals avoid the pitfalls of payday loans. Additionally, seeking financial counseling or advice and working towards improving credit scores can provide long-term financial stability. By staying informed and making responsible choices, individuals can navigate the financial landscape with confidence and avoid the risks associated with payday loans.

This image is property of www.consumer.gov.