If you’ve recently had your FHA loan application denied, it can be a frustrating experience. However, don’t despair! There are still options available to you. In this article, we’ll explore what you can do if you’ve been denied an FHA loan, including alternative loan options, steps to improve your credit, and strategies to increase your chances of approval in the future. Whether you’re looking for advice on dealing with bad credit loans or need guidance on finding a personal loan with no credit check, we’ve got you covered. So, keep reading to learn more about what to do when faced with an FHA loan denial.

Reasons for FHA Loan Denial

Credit history

One of the main reasons for FHA loan denial is a poor credit history. Lenders typically look at your credit score and credit report to assess your creditworthiness. If your credit history shows a pattern of late payments, defaults, or bankruptcy, it can negatively impact your chances of getting approved for an FHA loan. To avoid this, it is important to maintain a good credit score by paying your bills on time, keeping your credit card balances low, and avoiding opening too many new credit accounts.

Debt-to-income ratio

Another reason for FHA loan denial is a high debt-to-income ratio. Lenders consider your monthly debt payments in relation to your monthly income to determine if you can afford the mortgage payments. If your debt-to-income ratio is too high, it may signal to the lender that you have too much debt and may struggle to make the monthly payments. To improve your debt-to-income ratio, you can pay off existing debts, increase your income, or consider debt consolidation.

Insufficient income

If your income is not sufficient to cover the monthly mortgage payments, you may be denied an FHA loan. Lenders want to ensure that you have a stable and reliable source of income to make the mortgage payments on time. If your income is insufficient, you can explore additional income streams, consider a co-borrower or co-signer, reassess the loan amount and property price to find a more affordable option.

Employment history

Lenders also consider your employment history when deciding whether to approve your FHA loan application. They want to see a stable employment history and consistent income. If you have a history of frequent job changes or periods of unemployment, it may raise concerns for lenders about your ability to make consistent mortgage payments. To improve your employment history, it is important to stabilize your employment, show consistent income, and work towards job stability and tenure.

Property issues

Lastly, property issues can also lead to an FHA loan denial. If the property you are planning to buy has significant issues or does not meet certain FHA requirements, the lender may not approve the loan. It is important to assess the property appraisal, address any required repairs or renovations, and consider alternative properties that meet the FHA guidelines. If none of these options are viable, exploring different loan programs may be necessary.

This image is property of blog.easyknock.com.

Steps to Take After FHA Loan Denial

Evaluate the denial letter

When you receive a denial letter for your FHA loan application, it is important to carefully evaluate the reasons provided by the lender. The denial letter will outline the specific reasons for the denial, giving you insight into the areas you need to address and improve upon. By understanding the reasons for the denial, you can take the necessary steps to rectify the issues and increase your chances of approval in the future.

Review credit report

After a loan denial, it is crucial to review your credit report to identify any errors or inaccuracies that may have contributed to the denial. You can request a free copy of your credit report from the major credit bureaus and carefully examine it for any discrepancies. If you find any errors, you should dispute them with the credit bureaus to have them corrected. This can help improve your creditworthiness and increase your chances of approval for future loan applications.

Address credit issues

If your credit report reveals issues such as late payments, defaults, or high credit card balances, it is essential to address those credit issues. You can start by paying off outstanding debts and ensuring that you make all future payments on time. Additionally, establishing a positive credit history by responsibly using credit cards and maintaining low credit card balances can help improve your credit score and demonstrate your creditworthiness to lenders.

Improve debt-to-income ratio

If your debt-to-income ratio played a role in the FHA loan denial, you can take steps to improve it. Calculating your debt-to-income ratio can help you understand where you stand and determine how to reduce your debt or increase your income. Paying off existing debts, increasing your income through additional sources, or considering debt consolidation to combine high-interest debts into one manageable payment can help lower your debt-to-income ratio and improve your chances of loan approval.

Increase income

If insufficient income was a factor in the loan denial, exploring ways to increase your income can improve your chances of future loan approval. This can include seeking additional employment opportunities, exploring freelance or part-time work, or considering a side business. By increasing your income, you will have a stronger financial profile and demonstrate to lenders that you have the means to repay the loan.

Improve employment history

To address employment history concerns, it is important to stabilize your employment and demonstrate consistent income. This can be achieved by working towards job stability and tenure, avoiding frequent job changes, and ensuring a reliable source of income. A stable employment history can help lenders feel more confident in your ability to make consistent mortgage payments.

Address property concerns

If the property you intended to purchase had issues that led to the loan denial, it is crucial to address those concerns. Start by assessing the property appraisal and understanding the specific issues that led to the denial. If there are required repairs or renovations, consider completing them or obtaining estimates for their cost. Alternatively, you can explore different loan programs that may have more lenient property requirements.

This image is property of i0.wp.com.

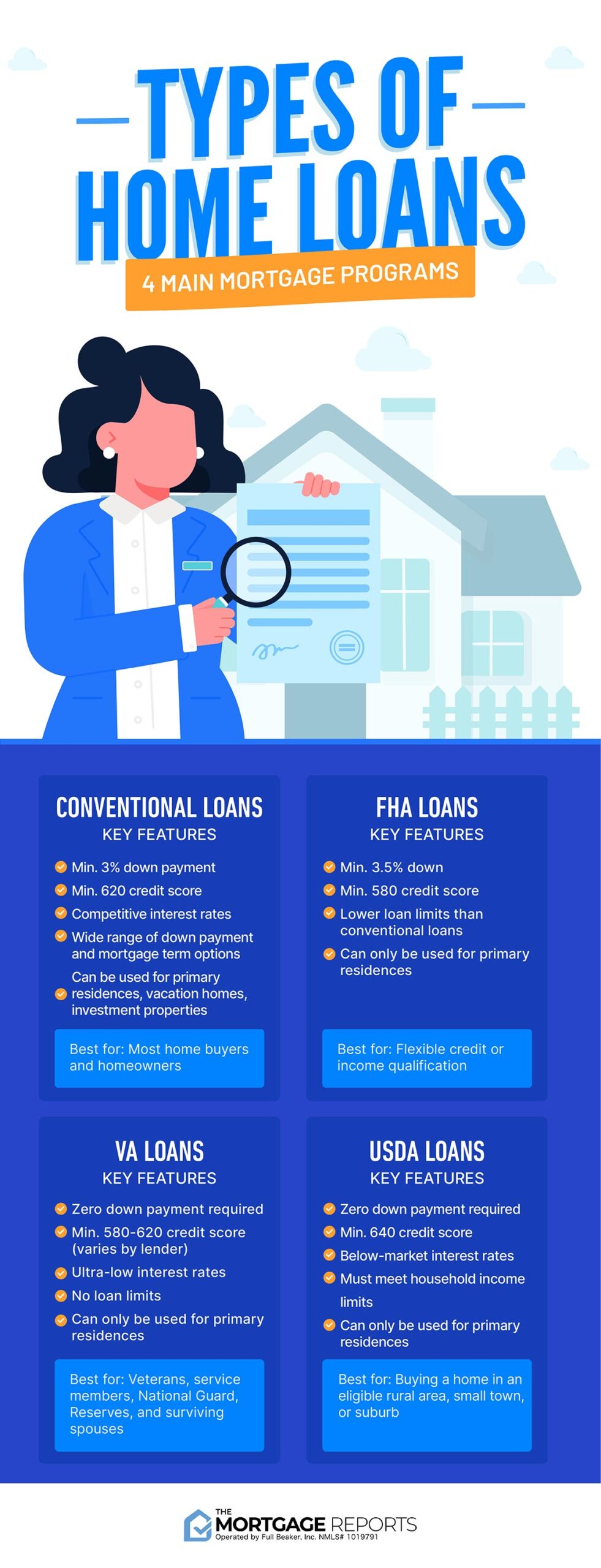

Alternative Loan Options

If your FHA loan is denied, it doesn’t mean that homeownership is out of reach. There are several alternative loan options that you can consider:

Conventional loans

Conventional loans are not insured by the Federal Housing Administration and typically have stricter eligibility requirements. However, they may offer competitive interest rates and flexible terms for borrowers with good credit scores and stable financial profiles.

USDA loans

USDA loans are offered through the United States Department of Agriculture and are designed to help low- to moderate-income individuals and families in rural areas. These loans offer competitive interest rates and require no down payment, making them an attractive option for those who meet the eligibility criteria.

VA loans

VA loans are available to eligible veterans, active-duty service members, and surviving spouses. These loans are offered by the Department of Veterans Affairs and often have more flexible eligibility requirements and favorable terms.

Private loans

Private loans, also known as conventional private loans or portfolio loans, are offered by private lenders and are not backed by the government. These loans may be suitable for borrowers who may not meet the strict requirements of traditional lenders but have unique circumstances that make them creditworthy.

Hard money loans

Hard money loans are short-term, high-interest loans that are typically used for real estate investments. These loans are issued by private lenders and are secured by the property itself, rather than the borrower’s creditworthiness. While the interest rates may be higher, hard money loans can be a viable option for borrowers with credit challenges.

This image is property of i.ytimg.com.

Working with a Mortgage Professional

If you have been denied an FHA loan, it can be beneficial to consult with a mortgage professional. A mortgage broker or lender can provide valuable insights and guidance on the best course of action. They will review the reasons for your loan denial and help you explore alternative loan options that may be better suited to your financial situation. Additionally, they can assist you in improving your creditworthiness and building a stronger loan application for future approval.

This image is property of blog.fha.co.

Building a Stronger Application

To increase your chances of loan approval in the future, it is important to work on building a stronger loan application. This can be achieved by implementing the following strategies:

Improve credit score

A higher credit score can significantly improve your chances of loan approval. Focus on paying bills on time, reducing credit card balances, and avoiding new debt. Additionally, regularly checking your credit report for errors and disputing any inaccuracies can help improve your credit score over time.

Decrease debts

Reducing your overall debt can improve your debt-to-income ratio and enhance your loan application. Make a plan to pay off outstanding debts, prioritize high-interest debts, and consider debt consolidation strategies if necessary.

Increase income

Demonstrating a higher income can make you a more attractive borrower. Explore ways to increase your income, such as taking on additional work or starting a side business. This can help improve your financial stability and increase your ability to make timely mortgage payments.

Establish stable employment

A stable employment history is an important factor in loan approval. Aim to establish stable employment by avoiding frequent job changes and demonstrating consistent income. This can help lenders feel confident in your ability to meet your financial commitments.

Save for a larger down payment

A larger down payment can lower your loan-to-value ratio and make you a less risky borrower. Start saving and aim to have a substantial down payment when you apply for your next home loan. This can increase your chances of loan approval and potentially offer you more favorable terms.

By following these steps and working towards a stronger loan application, you can improve your chances of approval for an FHA loan or other loan programs in the future. Remember to consult with a mortgage professional for personalized advice and guidance tailored to your specific situation.

This image is property of www.fhanewsblog.com.