If you’re a first-time home buyer, the world of mortgages and loans may seem overwhelming. But fear not! FHA loans are here to make the process a little easier. In this article, we will give you a comprehensive breakdown of FHA loans specifically tailored for first-time home buyers. From understanding the basics to the benefits and requirements, we’ve got you covered. So, get ready to take that first step towards becoming a proud homeowner with the help of FHA loans.

What are FHA loans?

Definition

FHA loans, which stands for Federal Housing Administration loans, are a type of mortgage loan that is insured by the Federal Housing Administration. This means that if you default on your loan, the FHA will reimburse the lender for the losses.

Purpose

The main purpose of FHA loans is to make homeownership more accessible and affordable for first-time home buyers and individuals with lower credit scores. These loans are particularly beneficial for those who may not be able to qualify for a conventional loan due to their credit history or financial situation.

Requirements

To qualify for an FHA loan, there are certain requirements that you must meet. These requirements include having a minimum credit score, having a stable income, and providing proof of residency. These requirements will be further discussed in the sections below.

Advantages of FHA loans

Lower down payment

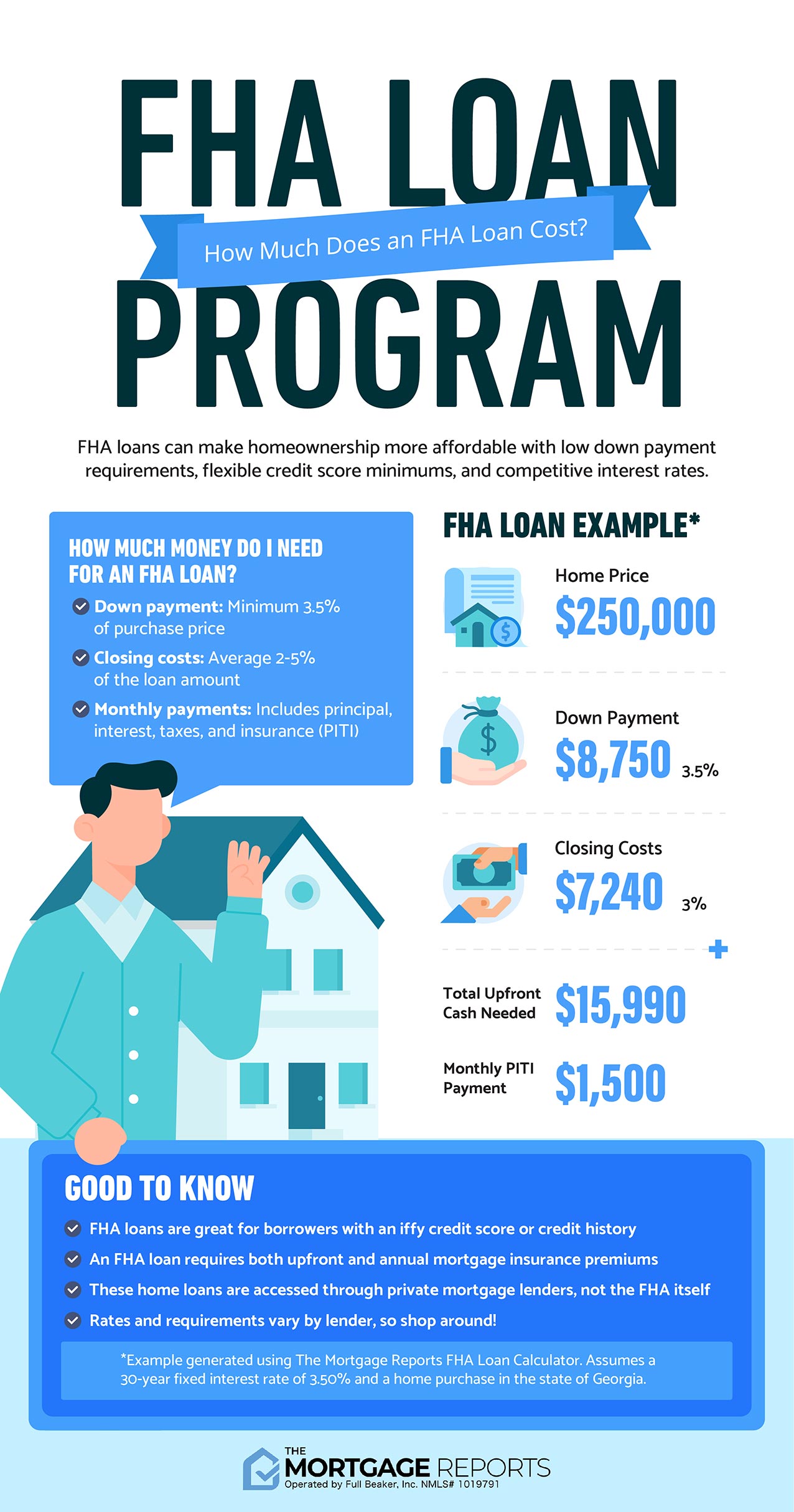

One of the major advantages of FHA loans is the lower down payment requirement. While conventional loans typically require a down payment of 20%, FHA loans allow for a down payment as low as 3.5% of the purchase price. This lower down payment requirement makes it easier for first-time home buyers and individuals with limited savings to purchase a home.

Lower credit score requirements

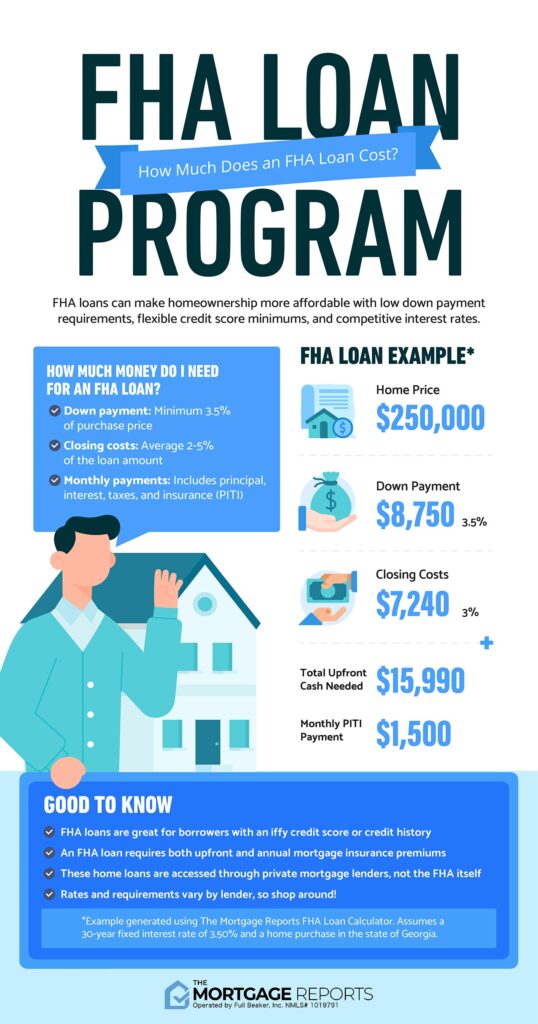

Another advantage of FHA loans is the lower credit score requirements. While conventional loans often require a minimum credit score of 620 or higher, FHA loans are more lenient and may accept borrowers with credit scores as low as 580. This makes FHA loans a viable option for individuals with less-than-perfect credit history.

Flexible debt-to-income ratio

FHA loans also offer more flexibility when it comes to the debt-to-income (DTI) ratio. The DTI ratio is a comparison of your monthly debt payments to your monthly income. Conventional loans typically have stricter DTI requirements, while FHA loans allow for a higher DTI ratio, making it easier for individuals with higher debt levels to qualify for a loan.

Assumable loans

One unique feature of FHA loans is that they are assumable. This means that if you decide to sell your home, the buyer can take over your FHA loan, subject to lender approval. This can be an attractive feature for potential buyers as it can save them from having to apply for a new mortgage and potentially secure a lower interest rate.

This image is property of assets.themortgagereports.com.

Types of FHA loans

Fixed-rate loans

Fixed-rate FHA loans are the most common type of FHA loan. With a fixed-rate loan, your interest rate remains the same throughout the life of the loan, providing stability and predictability in your monthly mortgage payments. This makes it easier for budgeting and planning for the long term.

Adjustable-rate loans

In contrast to fixed-rate loans, adjustable-rate FHA loans have an interest rate that is subject to change over time. These loans often start with a lower interest rate, but it can increase or decrease depending on market conditions. This type of loan can be beneficial if you plan to sell or refinance your home before the interest rate adjusts.

Energy-efficient mortgages

Energy-efficient mortgages are a type of FHA loan that allows borrowers to finance energy-efficient improvements for their home. These improvements can include solar panels, energy-efficient windows, and insulation. By financing these improvements through an FHA loan, borrowers can save on energy costs and reduce their environmental impact.

Home equity conversion mortgages

Home equity conversion mortgages, also known as reverse mortgages, are loans designed for homeowners aged 62 and older. These loans allow homeowners to convert a portion of their home’s equity into cash, which can be received as a lump sum, monthly payouts, or a line of credit. This type of FHA loan can provide additional financial flexibility for retirees.

How to qualify for an FHA loan

Credit score

While FHA loans are more forgiving of lower credit scores compared to conventional loans, there is still a minimum credit score requirement. Currently, the minimum credit score required for an FHA loan is typically around 580. However, borrowers with a credit score between 500 and 579 may still be eligible for an FHA loan, but they may need to make a larger down payment.

Income requirements

To qualify for an FHA loan, you must have a steady and verifiable income. Lenders will typically require you to provide documentation such as pay stubs, tax returns, and bank statements to demonstrate your income. FHA loans have no specific income requirements, but your debt-to-income ratio will be considered.

Employment history

A stable employment history is also important when applying for an FHA loan. Lenders will want to see that you have a consistent source of income and have been employed for at least two years. However, there are exceptions for borrowers who have recently graduated or have changed jobs but are in the same line of work.

Proof of residency

To be eligible for an FHA loan, you must be a U.S. citizen or have a valid Social Security number and be a lawful permanent resident. You will need to provide documentation such as a valid passport, driver’s license, or green card to prove your residency status.

This image is property of www.refiguide.org.

FHA loan limits

Explanation of loan limits

FHA loan limits refer to the maximum amount of money that can be borrowed using an FHA loan. These limits vary by county and are set by the Department of Housing and Urban Development (HUD). The loan limits are determined based on the median home prices in each area.

Factors that affect loan limits

Several factors can affect the loan limits for FHA loans. One of the main factors is the cost of housing in a particular area. Generally, areas with higher housing costs will have higher loan limits. Additionally, the number of units in a property can also affect the loan limits. For example, a single-family home will have a different loan limit compared to a multi-unit property.

Finding the loan limits for your area

To find the loan limits for your specific area, you can visit the HUD website or consult with an FHA-approved lender. These resources will provide you with the most up-to-date information regarding the loan limits in your county.

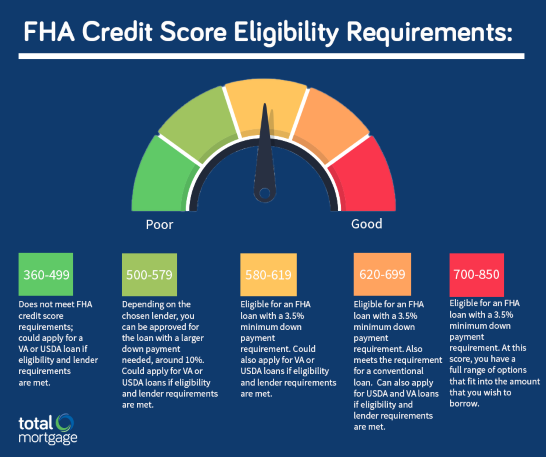

The FHA loan application process

Gathering required documents

Before starting the FHA loan application process, it is important to gather all the required documents. These documents include proof of income, tax returns, bank statements, identification documents, and proof of residency. Having these documents readily available will help streamline the application process.

Finding an FHA-approved lender

To apply for an FHA loan, you will need to work with an FHA-approved lender. These lenders have been approved by the FHA to offer FHA loans to borrowers. Researching and comparing different lenders will help you find the best rates and terms that suit your needs. You can find a list of FHA-approved lenders on the HUD website.

Submitting the application

Once you have chosen a lender, you can begin the application process. The lender will ask you to provide information about your income, employment history, credit history, and the property you wish to purchase. It is important to be truthful and accurate when completing the application to ensure a smooth approval process.

Waiting for approval

After submitting the application, the lender will review your information and make a decision on your loan application. The approval process typically takes a few weeks. During this time, the lender may request additional documentation or clarification on certain aspects of your application. Once your loan is approved, you can move forward with the closing process and prepare for homeownership.

This image is property of www.totalmortgage.com.

Fees associated with FHA loans

Upfront mortgage insurance premium

One fee associated with FHA loans is the upfront mortgage insurance premium (MIP). This fee is paid at the time of closing and is typically 1.75% of the loan amount. The MIP helps protect the lender in case the borrower defaults on the loan.

Annual mortgage insurance premium

In addition to the upfront MIP, FHA loans also require borrowers to pay an annual mortgage insurance premium (MIP). The MIP is typically divided into monthly payments and is based on the loan-to-value ratio, loan term, and the loan amount. The MIP helps to ensure the financial stability of the FHA loan program.

Closing costs

Like any other mortgage loan, FHA loans also have closing costs. These costs can include appraisal fees, title insurance fees, credit report fees, and attorney fees, among others. The closing costs can vary depending on the lender and the location of the property. It is important to factor in these costs when budgeting for your home purchase.

Common misconceptions about FHA loans

Only for first-time buyers

One common misconception about FHA loans is that they are only available for first-time home buyers. While FHA loans are popular among first-time buyers, they are not exclusive to this group. Anyone who meets the requirements can apply for an FHA loan, regardless of whether they have previously owned a home.

Limited home options

Another misconception is that FHA loans only apply to certain types of homes or properties. In reality, FHA loans can be used to finance a variety of properties, including single-family homes, multi-unit properties, and condominiums. However, the property must meet certain requirements, such as being safe, sound, and structurally adequate.

Difficult to qualify for

Some individuals may assume that FHA loans are difficult to qualify for due to the lower credit score requirements and more lenient criteria. However, FHA loans are designed to be more accessible to borrowers with lower credit scores and limited financial resources. By meeting the FHA loan requirements, many individuals can qualify for this type of loan.

This image is property of fhalenders.com.

Alternatives to FHA loans

Conventional loans

One alternative to FHA loans is conventional loans. Conventional loans are mortgages that are not insured or guaranteed by the government. These loans often have stricter requirements, including higher down payment and credit score requirements. However, conventional loans do not require the payment of mortgage insurance premiums.

USDA loans

USDA loans, also known as Rural Development loans, are another alternative to FHA loans. These loans are designed to help individuals with moderate incomes purchase homes in eligible rural and suburban areas. USDA loans often offer competitive interest rates and require no down payment.

VA loans

VA loans are mortgage loans available to eligible veterans, active-duty service members, and their spouses. These loans are guaranteed by the Department of Veterans Affairs and often offer favorable terms, including no down payment requirement and no mortgage insurance premiums.

Is an FHA loan right for you?

Pros and cons

Before deciding if an FHA loan is right for you, it is important to consider the pros and cons. The advantages of FHA loans include lower down payment requirements, lower credit score requirements, and more flexible debt-to-income ratios. However, FHA loans come with additional fees, such as upfront and annual mortgage insurance premiums, which can increase the overall cost of the loan.

Factors to consider

When determining if an FHA loan is suitable for your situation, there are several factors to consider. These include your credit score, income stability, and the cost of homeownership in your area. Additionally, it is important to compare FHA loan options to other types of mortgages to ensure that you are making an informed decision.

In conclusion, FHA loans offer many benefits that can make homeownership more accessible for first-time buyers and individuals with lower credit scores. By understanding the requirements, advantages, and alternatives to FHA loans, you can determine if this type of loan is the right fit for your home-buying journey.

This image is property of blog.mint.com.