Are you burdened with high debt-to-income ratio? Struggling to make ends meet and feeling overwhelmed by multiple loan payments? There’s a solution for you: high debt-to-income ratio consolidation loans. These loans are specifically designed to help individuals like you consolidate their debts into one manageable monthly payment. Whether you have bad credit or no credit, there are options available for you. With the help of these loans, you can simplify your finances and gain control over your debt. Say goodbye to the stress of multiple payments and take the first step towards financial freedom with high debt-to-income ratio consolidation loans.

Understanding Debt to Income Ratio

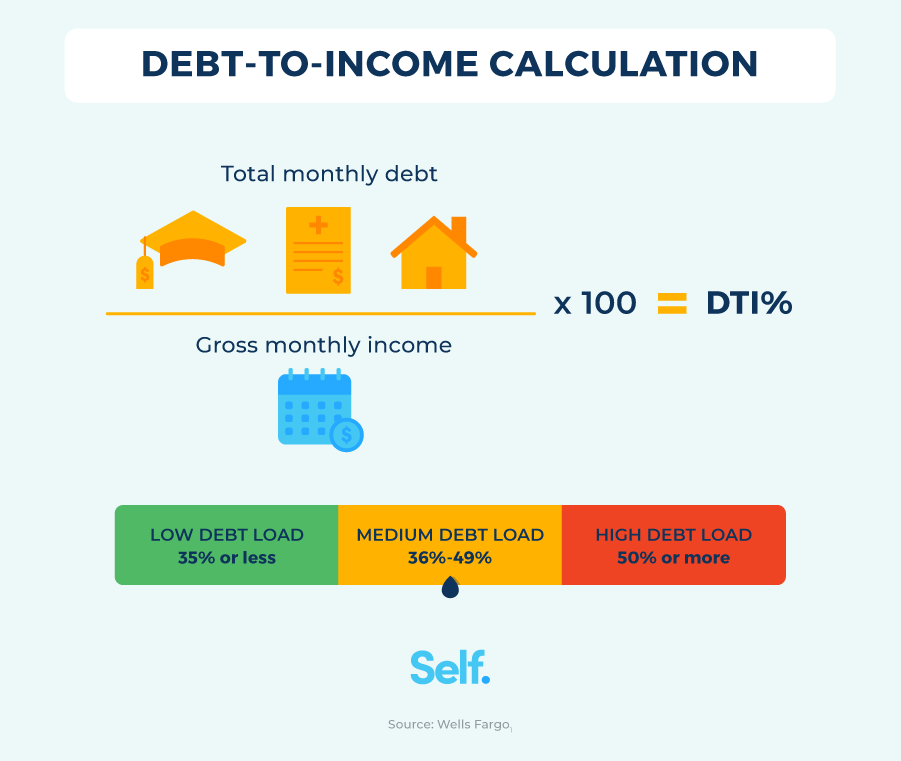

Debt to Income Ratio (DTI) is a financial metric that calculates the percentage of a person’s monthly income that goes towards paying off debt. It is an important factor that lenders consider during loan applications as it helps assess an individual’s ability to manage additional debt obligations.

Importance of Debt to Income Ratio in Loan Applications

When you apply for a loan, lenders evaluate various factors to determine your creditworthiness and ability to repay the loan. One crucial factor they consider is your Debt to Income Ratio. A low DTI indicates that you have a lower debt burden and are financially responsible, making you a more attractive borrower. On the other hand, a high DTI indicates a higher level of debt compared to your income, which can make lenders hesitant to provide you with additional credit.

This image is property of images.ctfassets.net.

What is a High Debt to Income Ratio?

A high Debt to Income Ratio typically means that you have a significant amount of debt compared to your monthly income. This can be a red flag for lenders, as it suggests that you may struggle to make your monthly payments and manage additional debt obligations.

Effects of High Debt to Income Ratio

Having a high Debt to Income Ratio can have several negative effects on your financial situation. It can limit your loan options, result in higher interest rates, and make it difficult for you to qualify for new credit.

This image is property of www.experian.com.

Challenges of High Debt to Income Ratio

Limited Loan Options

When you have a high Debt to Income Ratio, your options for obtaining new loans become limited. Traditional lenders may be hesitant to provide you with credit due to the additional risk involved. This can make it challenging to access funds for various purposes such as purchasing a home, financing a car, or funding a business venture.

Higher Interest Rates

Even if you manage to secure a loan with a high Debt to Income Ratio, you may face higher interest rates compared to borrowers with lower DTIs. Lenders may charge higher rates to compensate for the increased risk associated with lending to individuals with higher debt burdens. This can result in you paying more in interest over the life of the loan, making it harder to pay off your debts.

Difficulty in Qualifying for New Credit

A high Debt to Income Ratio can make it harder for you to qualify for new credit. Lenders are more cautious when extending credit to individuals with a significant amount of debt compared to their income. Your high DTI may signal to lenders that you already have a heavy debt load and may struggle to make additional payments.

The Benefits of Consolidation Loans

If you have a high Debt to Income Ratio and are struggling to manage your debts, consolidation loans can provide several benefits. By combining multiple debts into one loan, you can simplify your financial obligations and potentially improve your financial situation.

Simplifying Multiple Debts into One

Consolidation loans allow you to merge multiple debts, such as credit card balances, personal loans, and medical bills, into one single loan. This simplifies your monthly payments by consolidating them into a single payment, making it easier to keep track of and manage your debts.

Lower Interest Rates

Consolidation loans often come with lower interest rates compared to the interest rates of your individual debts. By obtaining a consolidation loan with a lower interest rate, you can save money on interest payments over time.

Reducing Monthly Payments

Consolidation loans can also help reduce your monthly payments by extending the repayment term. By spreading your payments over a longer period, you can lower the monthly amount you need to pay, potentially easing the burden of your debt obligations.

Improving Credit Score

Consolidation loans can positively impact your credit score if you manage them responsibly. By making timely payments on your consolidation loan, you demonstrate your ability to handle credit responsibly, which can improve your credit score over time.

This image is property of blog.mint.com.

Types of Consolidation Loans

There are two main types of consolidation loans: secured and unsecured.

Secured Consolidation Loans

Secured consolidation loans require collateral, such as a home or a vehicle, to secure the loan. This collateral acts as security for the lender, reducing the risk involved in lending to individuals with high Debt to Income Ratios. Secured consolidation loans often come with lower interest rates but carry the risk of losing the collateral if you default on the loan.

Unsecured Consolidation Loans

Unsecured consolidation loans do not require collateral and are based solely on your creditworthiness. These loans can be more difficult to obtain if you have a high Debt to Income Ratio, as lenders may be reluctant to extend credit without the security of collateral. However, if you qualify for an unsecured consolidation loan, you won’t have to worry about losing any collateral.

Requirements for High Debt to Income Ratio Consolidation Loans

If you have a high Debt to Income Ratio and are considering a consolidation loan, there are several requirements you need to meet to increase your chances of approval.

Proof of Income

Lenders will require proof of income to ensure that you have a steady source of funds to make your loan payments. This can be in the form of pay stubs, bank statements, or tax returns.

Credit Score Check

Lenders will also check your credit score to assess your creditworthiness. A higher credit score indicates financial responsibility and makes it easier to qualify for a consolidation loan. However, even with a lower credit score, some lenders may still offer consolidation loans, albeit at higher interest rates.

Debt to Income Ratio Limit

Lenders typically have a maximum Debt to Income Ratio limit that they are willing to accept when considering consolidation loan applications. It is essential to know the specific DTI limit of the lender you choose to apply with to ensure that your ratio falls within their acceptable range.

This image is property of www.credello.com.

Tips for Getting Approved for High Debt to Income Ratio Consolidation Loans

If you have a high Debt to Income Ratio and want to improve your chances of getting approved for a consolidation loan, consider the following tips:

Improve Credit Score

Take steps to improve your credit score by making timely payments on existing debts and reducing your credit card balances. Paying off any outstanding delinquencies and avoiding new credit inquiries can also positively impact your credit score.

Increase Income

When you have a high Debt to Income Ratio, increasing your income can help improve your debt-to-income ratio and make you a stronger candidate for a consolidation loan. Consider exploring additional income streams or asking for a raise at work to boost your monthly earnings.

Reduce Debt

Take proactive steps to reduce your debt burden by paying off high-interest debts or negotiating with creditors for better repayment terms. By reducing your overall debt, you can lower your Debt to Income Ratio and increase your chances of approval for a consolidation loan.

Consider Co-Signer

If you are struggling to qualify for a consolidation loan on your own due to a high Debt to Income Ratio, consider enlisting a co-signer with a strong credit history and income. A co-signer can help strengthen your application and increase the likelihood of approval.

Where to Find High Debt to Income Ratio Consolidation Loans

If you have a high Debt to Income Ratio and are seeking consolidation loan options, several lenders cater to individuals in your situation.

Traditional Banks

Traditional banks often offer consolidation loan products tailored to individuals with high Debt to Income Ratios. By visiting your local bank, you can inquire about their specific requirements and loan terms.

Online Lenders

Online lenders provide a convenient and accessible option for individuals seeking consolidation loans. Many online lenders specialize in catering to borrowers with less-than-perfect credit, making them a viable choice for those with high Debt to Income Ratios.

Credit Unions

Credit unions are not-for-profit financial institutions that often offer more flexible lending terms than traditional banks. They may have specific programs in place to assist individuals with high Debt to Income Ratios in consolidating their debts.

This image is property of www.badcredit.org.

Alternatives to Consolidation Loans for High Debt to Income Ratio

If you are unable to qualify for a consolidation loan due to your high Debt to Income Ratio, there are alternative options you can consider.

Debt Management Programs

Debt management programs involve working with a credit counseling agency to develop a repayment plan that suits your financial situation. These programs often negotiate with your creditors to lower interest rates and monthly payments, making it easier to manage your debts.

Debt Settlement

Debt settlement involves negotiating with your creditors to settle your debts for less than the full amount owed. This option can provide some relief from high debt levels but can also have a negative impact on your credit score.

Bankruptcy

Bankruptcy should be considered as a last resort option for those with high Debt to Income Ratios. It involves legally declaring yourself unable to meet your debt obligations and may have long-term consequences on your creditworthiness.

Choosing the Right Loan Option

When selecting a consolidation loan, it is essential to consider various factors to ensure that it aligns with your financial goals and needs.

Comparing Interest Rates

Compare the interest rates offered by different lenders to find the most favorable terms. A lower interest rate can save you a significant amount of money over the life of the loan.

Considering Repayment Terms

Review the repayment terms of different consolidation loans to determine which one suits your financial situation. Longer repayment terms may result in lower monthly payments but may also mean paying more in interest over time.

Analyzing Additional Fees and Penalties

Pay attention to any additional fees or penalties associated with the consolidation loan. Some lenders may charge origination fees or prepayment penalties, which can impact the overall cost of the loan.

In conclusion, a high Debt to Income Ratio can pose several challenges, but consolidation loans offer a potential solution. By consolidating your debts into one loan, you can simplify your financial obligations and potentially improve your credit score. However, it is crucial to carefully consider your options, meet the requirements, and choose the right loan option that suits your needs and financial goals. Remember to take proactive steps to improve your credit score, increase your income, and reduce your debt to enhance your chances of approval for a consolidation loan.