Whether you’re looking to buy a house, start a business, or fund a personal project, understanding the basics of lending is essential. In this article, we will provide you with an informative introduction to lending, covering key concepts and important factors that everyone should be aware of. From types of loans to interest rates and credit scores, we’ve got you covered. So, let’s get started and expand your knowledge on this fundamental aspect of personal and financial growth!

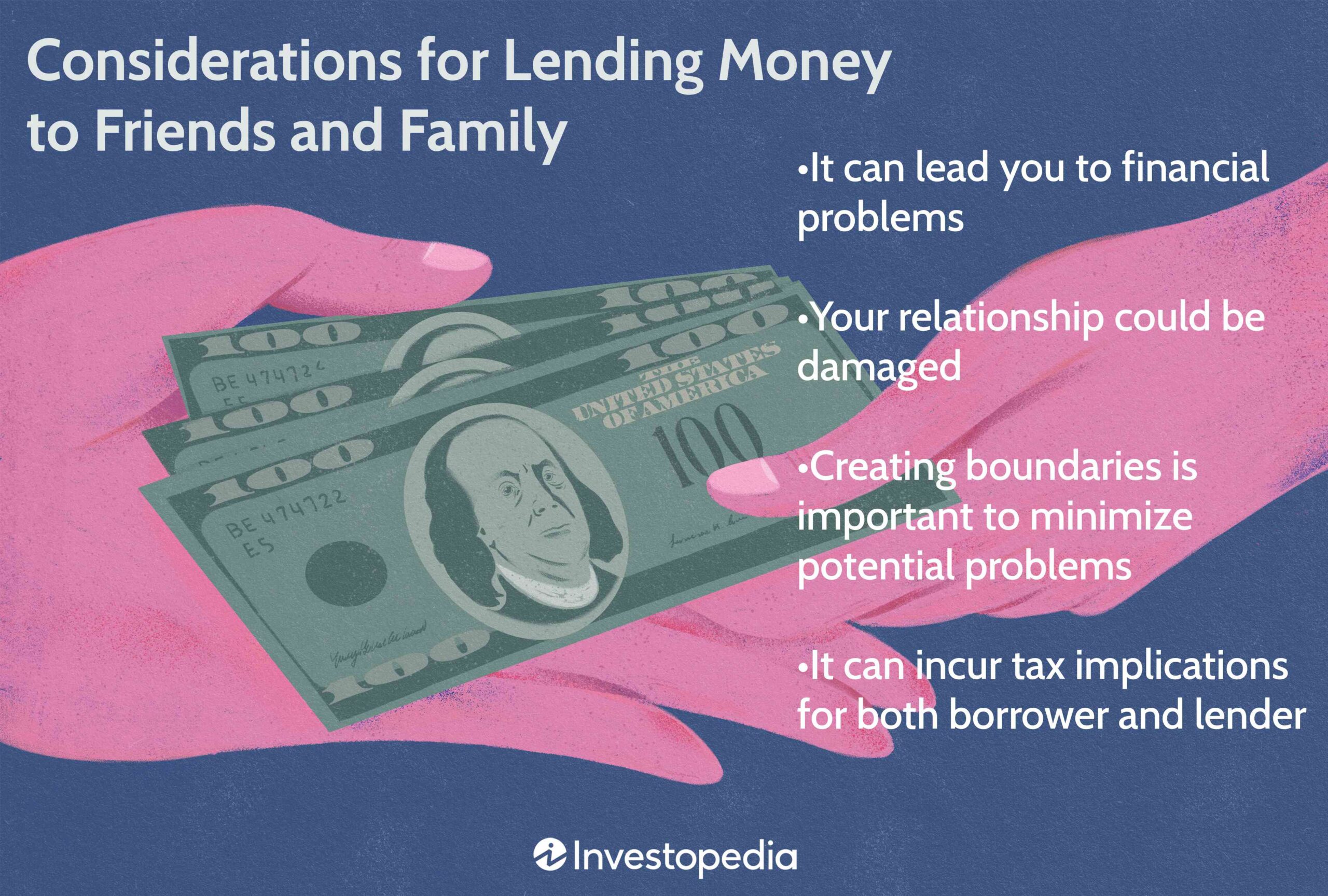

This image is property of www.investopedia.com.

What is Lending?

Definition of lending

Lending refers to the act of providing money or assets to another party, known as the borrower, with the expectation that it will be repaid, usually with interest, over a specified period of time. It is a common financial practice where individuals, businesses, or institutions lend money to individuals, businesses, or governments to meet their financial needs and goals.

Purpose of lending

The purpose of lending is to provide individuals and businesses with access to funds that they may not have readily available. Whether it’s for purchasing a home, starting a business, or funding an educational endeavor, loans offer opportunities to fulfill aspirations and achieve financial stability. Lending allows borrowers to obtain capital while enabling lenders to earn interest on their investments.

Types of Lenders

Commercial banks

Commercial banks are the most traditional and well-known type of lender. They play a vital role in the lending industry by providing loans to both individuals and businesses. Commercial banks accept deposits from individuals and use those funds to lend money to borrowers. They offer a wide range of loan products, such as mortgages, auto loans, and personal loans, often with competitive interest rates.

Credit unions

Credit unions are member-owned financial cooperatives that offer lending services to their members. Unlike commercial banks, which are profit-oriented, credit unions prioritize the interests of their members. They often provide loans at lower interest rates and more favorable terms than other financial institutions. Credit unions focus on building relationships with their members and aim to serve specific communities or occupational groups.

Online lenders

With the advent of the internet, online lenders have emerged as convenient alternatives to traditional lending institutions. Online lenders operate exclusively through digital platforms, allowing borrowers to apply for loans online and receive funds quickly. These lenders often have less strict eligibility requirements and more flexible loan terms. Their efficiency and accessibility make online lending popular among individuals and small businesses.

Loan Types

Secured loans

Secured loans are loans that require collateral, which is an asset that the borrower pledges to the lender as security for the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral and sell it to recover the loan amount. Common examples of secured loans include mortgages and auto loans. Because of the reduced risk for the lender, secured loans generally have lower interest rates than unsecured loans.

Unsecured loans

Unsecured loans, on the other hand, do not require collateral. These loans are based solely on the borrower’s creditworthiness, such as their credit score, income, and employment history. Because there is no asset backing the loan, unsecured loans are considered riskier for lenders. Therefore, they typically come with higher interest rates and more stringent eligibility criteria. Credit cards, personal loans, and student loans are commonly categorized as unsecured loans.

Fixed-rate loans

Fixed-rate loans have an interest rate that remains the same throughout the loan term. Borrowers know exactly how much their monthly payments will be and can plan their budgets accordingly. These loans provide stability and predictability, making them suitable for those who prefer a consistent repayment schedule. Mortgages and personal loans often offer fixed-rate options.

Variable-rate loans

Variable-rate loans, also known as adjustable-rate loans, have an interest rate that can fluctuate over time. The rate is usually tied to a benchmark, such as the prime rate or LIBOR, and can change periodically. Variable-rate loans offer the potential for lower initial interest rates, but they come with uncertainty as the rates may increase in the future. Adjustable-rate mortgages and some student loans fall into this category.

Key Players in the Lending Process

Borrower

The borrower is the individual, business, or institution that seeks a loan. Borrowers have specific financial needs or goals that they aim to achieve with the borrowed funds. They must meet certain eligibility criteria and provide the necessary documentation to apply for a loan. It is their responsibility to repay the loan according to the agreed-upon terms and conditions.

Lender

The lender is the entity, such as a bank, credit union, or online lending platform, that provides the loan to the borrower. Lenders evaluate the borrower’s creditworthiness and assess the risk associated with extending credit. They set the terms and conditions of the loan, including the interest rate, repayment period, and fees. Lenders make a profit by earning interest on the loans they provide.

Loan officer

Loan officers work for lending institutions and are responsible for assisting borrowers throughout the loan application process. They help applicants understand different loan options, gather necessary documents, and complete the application. Loan officers also evaluate the borrower’s creditworthiness, income, and employment history to determine their eligibility for a loan. They play a crucial role in facilitating communication between the borrower and the lender.

Underwriter

Underwriters are employed by lending institutions and are responsible for assessing the risk involved in lending money. They review loan applications, analyze financial documents, and verify the information provided by the borrower. Underwriters evaluate the borrower’s creditworthiness, income, and employment history to determine if the loan should be approved. They help lenders make informed decisions by assessing the borrower’s ability to repay the loan.

This image is property of www.investopedia.com.

Factors Considered for Loan Approval

Credit score

A credit score is a three-digit number that represents an individual’s creditworthiness and their history of repaying debts. Lenders use credit scores, such as FICO scores, to evaluate a borrower’s risk profile. A higher credit score indicates a lower risk of default and increases the chances of loan approval. Lenders consider factors like payment history, credit utilization, length of credit history, and credit mix when assessing credit scores.

Income and employment history

Lenders evaluate a borrower’s income and employment history to determine their ability to repay a loan. Regular and stable income demonstrates financial stability and indicates a lower risk of default. Lenders may require borrowers to provide proof of income, such as pay stubs or tax returns, to assess their repayment capacity. Those with a consistent employment history may be more likely to obtain loan approval.

Debt-to-income ratio

The debt-to-income (DTI) ratio is a measure of an individual’s monthly debt obligations in relation to their gross monthly income. Lenders calculate the DTI ratio to assess a borrower’s ability to manage additional debt. A lower DTI ratio suggests a lower risk of default and increases the chances of loan approval. Lenders typically prefer borrowers with a DTI ratio below a certain threshold, often around 43%.

Loan Application Process

Pre-qualification

Before applying for a loan, borrowers can undergo a pre-qualification process to determine their eligibility and potential loan terms. Pre-qualification involves a preliminary assessment of the borrower’s financial information, such as income, credit score, and debt levels. Lenders use this information to provide an estimate of the loan amount, interest rate, and repayment terms the borrower may qualify for. Pre-qualification helps borrowers understand their borrowing potential without impacting their credit score.

Submission of documents

Once borrowers are ready to apply for a loan, they are required to submit relevant documents to support their application. These documents may include proof of identity, income verification, bank statements, tax returns, and employment history. Lenders rely on these documents to evaluate the borrower’s creditworthiness and ability to repay the loan. Submitting accurate and complete documents is crucial to ensure a smooth loan application process.

Loan processing

Once all the required documents have been submitted, the loan processing phase begins. During this stage, the lender reviews and verifies the information provided by the borrower. The loan officer or underwriter assesses the borrower’s creditworthiness, income, and employment history to determine if the loan meets the lender’s criteria. Loan processing involves a thorough evaluation of all the necessary factors to determine the borrower’s eligibility for the loan.

Loan approval

If the borrower meets the lender’s criteria, the loan application will be approved. The lender will communicate the approval and provide the borrower with the details of the loan, such as the loan amount, interest rate, repayment period, and any associated fees. The borrower will need to review and sign the loan agreement to finalize the loan process. Loan approval is a significant milestone for borrowers as it signifies their eligibility to receive the funds they need.

This image is property of www.investopedia.com.

Loan Terms and Conditions

Interest rates

Interest rates represent the cost of borrowing money and are a crucial factor in loan terms. Lenders determine the interest rate based on the borrower’s creditworthiness, prevailing market rates, and the type of loan. Higher credit scores and lower risks typically result in lower interest rates. Interest rates can be fixed, meaning they remain constant throughout the loan term, or variable, meaning they can fluctuate with changes in the market.

Loan amount

The loan amount refers to the total sum of money that the lender agrees to provide to the borrower. The loan amount depends on various factors, such as the borrower’s financial situation, creditworthiness, and the purpose of the loan. Lenders may have minimum and maximum loan amounts based on their internal policies and loan programs. Borrowers should carefully consider their financial needs and limitations when determining the loan amount.

Repayment period

The repayment period, also known as the loan term, represents the duration over which the borrower is required to repay the loan. Loan terms can range from a few months to several decades, depending on the type of loan and the lender’s terms. Shorter loan terms often result in higher monthly payments but provide quicker repayment. Longer loan terms may have lower monthly payments but result in more interest paid over time.

Fees and charges

In addition to the loan amount and interest rate, borrowers may be responsible for various fees and charges associated with the loan. These fees can include origination fees, appraisal fees, credit report fees, and closing costs. Lenders disclose these fees to borrowers as part of the loan agreement. It is essential for borrowers to carefully review and understand all fees and charges before accepting a loan to avoid any surprises during the repayment period.

Loan Repayment Options

Equal monthly installments

The most common method of loan repayment is through equal monthly installments. Under this repayment option, borrowers repay a fixed amount every month, consisting of both principal and interest. The monthly payment remains the same throughout the repayment period, providing borrowers with consistency and predictability. Equal monthly installments allow borrowers to budget effectively and ensure timely repayment of the loan.

Balloon payment

In some cases, loans may have a balloon payment structure. A balloon payment is a lump sum payment that is due at the end of the loan term, usually for loans with a longer repayment period. Borrowers make monthly payments, typically lower than traditional loan payments, throughout the loan term. However, at the end of the term, they must repay the remaining principal balance in one large payment. Balloon payments require careful planning to ensure borrowers have the means to meet the final payment obligation.

Interest-only payments

Interest-only payments allow borrowers to pay only the interest portion of the loan for a certain period, usually during the initial period of the loan term. This option can provide temporary relief by reducing monthly payment amounts. However, borrowers need to understand that interest-only payments do not reduce the principal amount owed. Once the interest-only period ends, borrowers will need to begin making payments that include both principal and interest, which may result in higher monthly payments.

This image is property of Amazon.com.

Credit Reports and Scores

Understanding credit reports

A credit report is a detailed record of an individual’s credit history, including their borrowing and repayment behavior. It contains information such as credit accounts, payment history, outstanding debts, and public records. Credit reports are maintained by credit bureaus, such as Experian, Equifax, and TransUnion, which collect data from various sources. Understanding credit reports allows borrowers to assess their creditworthiness and identify areas for improvement.

Importance of credit scores

Credit scores are numerical representations of an individual’s creditworthiness based on the information in their credit report. Lenders use credit scores to assess the risk of extending credit to a borrower. A higher credit score indicates a lower risk of default and increases the chances of loan approval. Credit scores also influence the terms and conditions of the loan, such as the interest rate and loan amount. Maintaining a good credit score is crucial for accessing favorable loan options and lower interest rates.

Default and Loan Default Prevention

Definition of loan default

Loan default occurs when a borrower fails to make their loan payments as agreed upon in the loan agreement. It is a serious financial situation that can have significant consequences for both the borrower and the lender. Defaulting on a loan can damage the borrower’s credit score, result in late fees and penalties, and potential legal action. Lenders may be forced to seize collateral or initiate collection efforts to recover the outstanding loan amount.

Effects of default

Defaulting on a loan can have long-lasting effects on the borrower’s financial well-being. It can adversely impact their credit score, making it difficult to obtain future credit and potentially affecting their ability to rent an apartment or secure employment. Additionally, defaulted loans may result in the loss of collateral and legal consequences. For lenders, loan defaults can lead to financial losses, increased costs, and a negative impact on their reputation.

Loan default prevention measures

To prevent loan defaults, borrowers should prioritize proper financial management and responsible borrowing. This includes making loan payments on time, maintaining a healthy credit score, and living within their means. Borrowers can also explore options such as refinancing or loan modifications if they anticipate difficulty in meeting their loan obligations. For lenders, comprehensive evaluation of borrowers’ creditworthiness, income verification, and effective communication throughout the loan term can help minimize the risk of loan defaults.

In conclusion, lending plays a vital role in facilitating individuals and businesses in achieving their financial objectives. By understanding the different types of lenders, loan options, key players in the lending process, factors considered for loan approval, loan terms and conditions, repayment options, credit reports and scores, as well as the importance of default prevention, borrowers can navigate the lending landscape confidently. It is crucial for borrowers to approach lending responsibly, considering their needs, capabilities, and the potential impact on their financial well-being. Lending provides opportunities for growth and financial progress, but it is essential for borrowers to assess their requirements and obligations before committing to a loan.

This image is property of blog.ipleaders.in.