Are you struggling under the burden of student loan debt? Good news! This article provides updates on student loan forgiveness programs, which could potentially offer relief to borrowers like you. From understanding the differences between federal and private loans to exploring options like income-driven repayment plans and loan discharge, this piece covers a range of topics related to student loan forgiveness. Whether you’re a teacher looking for loan forgiveness through public service or a borrower facing financial hardship, this article aims to provide valuable information to help you navigate the complex world of student loan forgiveness programs.

This image is property of studentaid.gov.

How To Access Up To One Million Dollars Without Any Proof Of Income

Student Loan Forgiveness Programs

If you’re struggling to repay your student loans, you’re not alone. Many borrowers find themselves burdened by the weight of their education debt, unable to keep up with monthly payments. Fortunately, there are student loan forgiveness programs available to help alleviate this financial stress. In this comprehensive guide, we will explore both federal and private loan forgiveness programs, as well as provide detailed information on each program’s criteria and application processes.

How To Access Up To One Million Dollars Without Any Proof Of Income

Federal Loan Forgiveness Programs

The federal government offers several loan forgiveness programs for borrowers with federal student loans. These programs are designed to provide relief to borrowers who meet specific eligibility criteria. Let’s delve into some of the most popular federal loan forgiveness programs.

Income-driven Repayment Plans

Income-driven repayment plans are a great option for borrowers who have a high debt-to-income ratio. Under these plans, your monthly loan payments are calculated based on a percentage of your discretionary income. There are three main income-driven repayment plans available: Pay As You Earn (PAYE), Revised Pay As You Earn (REPAYE), and Income-Based Repayment (IBR). These plans offer loan forgiveness after a certain number of qualifying payments.

Public Service Loan Forgiveness

The Public Service Loan Forgiveness (PSLF) program is designed for borrowers who work in public service or non-profit organizations. To be eligible for PSLF, you must make 120 qualifying payments while employed full-time by a qualifying employer. After meeting these requirements, the remaining balance on your federal loans may be forgiven.

Teacher Loan Forgiveness

Teachers play a vital role in shaping our future, and to recognize their service, the Teacher Loan Forgiveness program was established. This program offers loan forgiveness of up to $17,500 for qualified teachers who meet specific eligibility criteria. Eligible teachers must have served in low-income schools or educational service agencies for five consecutive years.

Loan Discharge for Total and Permanent Disability

If you experience a total and permanent disability that prevents you from repaying your federal student loans, you may be eligible for loan discharge. This program offers relief to borrowers facing severe financial hardship due to their disability. To qualify, you must provide documentation of your disability from a certified healthcare professional.

Loan Discharge for Military Service

Active duty military personnel may be eligible for loan discharge under certain circumstances. If you are serving in the military and your service prevents you from repaying your federal student loans, you may qualify for loan discharge. It’s important to consult with your loan servicer and provide documentation of your military service to determine your eligibility.

Borrower Defense to Repayment

The Borrower Defense to Repayment program provides relief to borrowers who were defrauded by their educational institutions or have experienced misconduct. Under this program, you may be eligible for loan forgiveness if you can demonstrate that your school engaged in deceptive practices or violated certain laws. The application process requires you to provide evidence of the school’s misconduct.

This image is property of www.sdtplanning.com.

How To Access Up To One Million Dollars Without Any Proof Of Income

Private Loan Forgiveness Programs

While most loan forgiveness programs are offered by the federal government, some private lenders also offer forgiveness options for their borrowers. It’s important to note that private loan forgiveness programs vary greatly, and it is crucial to review the terms and conditions of your specific loan agreement. Let’s explore some common borrower options and loan servicer programs.

Borrower Options

Private loan borrowers should explore various options for loan forgiveness. Some lenders may offer forgiveness for borrowers who make a certain number of on-time payments. Others may have programs that forgive a portion of the loan balance after a specific time period. Be sure to reach out to your loan servicer to inquire about available forgiveness options.

Loan Servicer Programs

Private loan servicers may have their own loan forgiveness programs for borrowers facing financial hardship. These programs often provide options such as temporary deferment, forbearance, or modification of loan terms. It’s important to contact your loan servicer directly to discuss available programs and determine the best course of action for your situation.

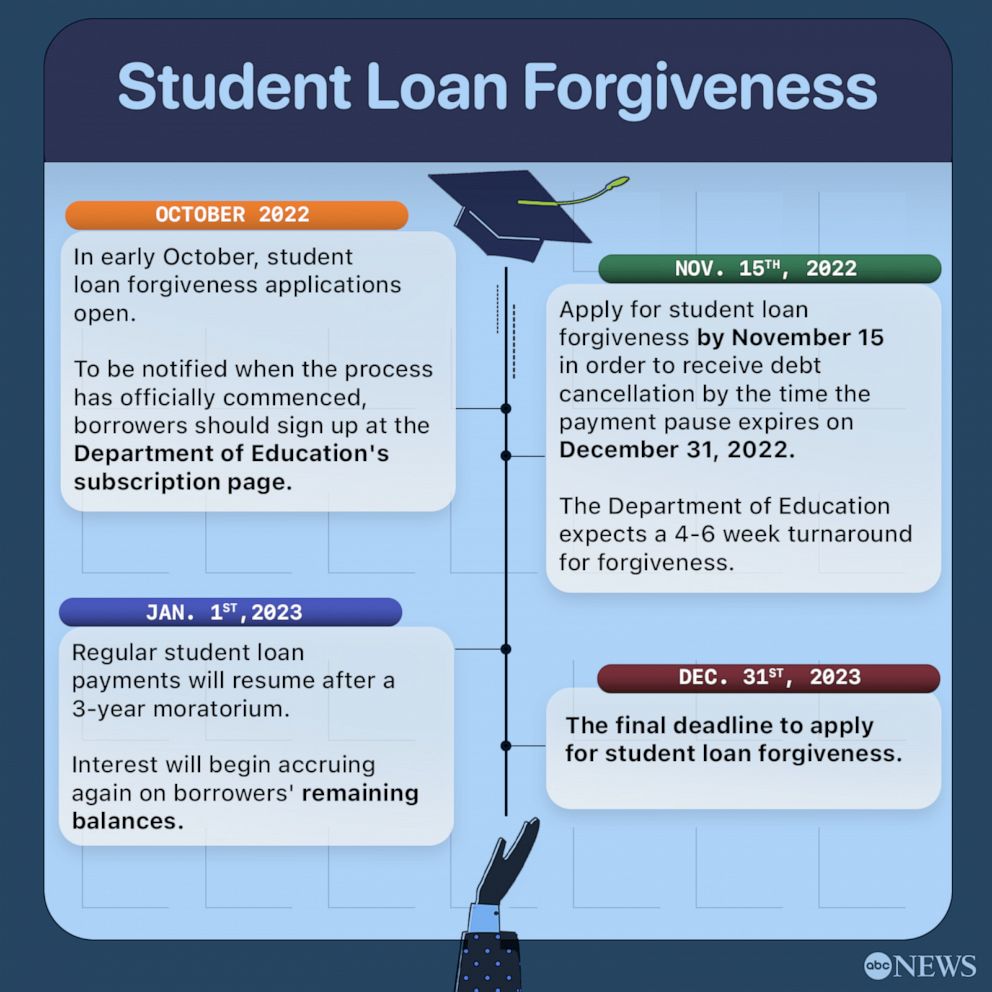

This image is property of s.abcnews.com.

How To Access Up To One Million Dollars Without Any Proof Of Income

Impact of COVID-19 and the CARES Act

The COVID-19 pandemic has had a significant impact on student loan borrowers, prompting the introduction of the CARES Act. This legislation provided temporary relief measures to alleviate the financial burdens caused by the pandemic. Let’s explore some of the key provisions that may affect student loan forgiveness.

Temporary Relief for Borrowers

Under the CARES Act, federal student loan borrowers were provided with temporary relief in the form of suspended loan payments. This relief was initially implemented in response to the economic challenges brought about by the pandemic. It’s important to stay updated with the latest information regarding any extensions or changes to this temporary relief.

Suspension of Loan Payments

During the relief period, eligible borrowers were not required to make monthly payments on their federal student loans. Additionally, interest on these loans was temporarily set to 0% for the designated relief period. This provided much-needed financial breathing room for borrowers who may have faced economic hardship due to the pandemic.

Emergency Financial Aid and Debt Relief Programs

The CARES Act also allocated funds for emergency financial aid and debt relief programs. These programs aimed to provide additional support to students and borrowers facing financial challenges during the pandemic. These initiatives varied across academic institutions, so it’s important to reach out to your institution’s financial aid office for information on available programs.

In conclusion, student loan forgiveness programs can provide much-needed relief to borrowers struggling with the burden of educational debt. Whether you have federal or private loans, it’s important to explore the options available to you. By understanding the eligibility criteria and application processes outlined in this guide, you can take steps towards securing financial freedom and building a brighter future. Remember to stay informed and proactive on the latest updates regarding student loan forgiveness programs, as legislation and relief measures may evolve over time.

How To Access Up To One Million Dollars Without Any Proof Of Income